Wyshbox Life Insurance study shows how the pandemic, inflation and looming recession has led to women worrying about their financial future.

Through interviews and surveys of over 400 working women between the ages 20-45 years, the numbers aren’t good for how women feel about their financial future.

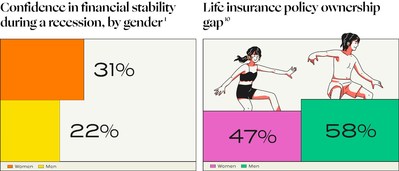

It’s no surprise that women have had to deal with unprecedented volatility over the past few years. The (financially) unprotected sex by Wyshbox Life Insurance includes interviews and surveys of over 400 women and takes a deep dive into how much of a negative financial impact the pandemic, inflation and fears of a potential recession in the future has had on women of different ages and cultural backgrounds. We’ve discovered that 83% of women surveyed worry about high inflation in the future, which has increased their household expenses and has had a negative effect on their purchasing power. Shockingly, the biggest worry for women of color (35% surveyed) is that their wages are not keeping pace with rising expenses, a worry not shared as strongly by caucasian women.1

New study shows how the pandemic, inflation and looming recession has women worrying about their financial future.

Found on our website at www.wyshbox.com/women, The (financially) unprotected sex white paper not only seeks to understand the emotional and financial burdens and worries of women of different racial backgrounds, but also their employment and childcare struggles when compared to men.

“An eye-opening learning we found was that 30% of caucasian women versus 42% of women of color had to quit their job over the pandemic,” says Hetal Karani, Senior Strategist who led the research effort for Wyshbox. Those who had quit the workforce cited pursuing higher education opportunities, limited childcare availability and a lack of alternative schooling options as their main reason to exit the labor market—in addition to not wanting to risk their family’s health after being denied remote working options by their employer.1

Coupled with the importance of a mother’s salary and a steep rise in dual income households, we found these learnings particularly troubling. “More than 70% percent of households with children under 18 years rely on the woman’s salary, and 40% of moms are the primary breadwinner for the home,”1 added Hetal, “yet our emphasis on the importance of financial planning for the well being of women and their families has remained stagnant”

And when it comes to protecting their future, 70% of mothers said they were worried about what would happen to their families if they passed away.2 So it was no surprise that Wyshbox Life Insurance saw an unprecedented level of women applying for Life Insurance, well above the historical average. Applicants were looking to protect their children and spouse should they lose their salary unexpectedly, cover their mortgages to protect their family from losing their home pay out to a college tuition that they have been saving for.

Read The (Financially) Unprotected Sex white paper for insights and actionable takeaways for not only the insurtech industry, but for anyone looking to understand how women are taking on the new challenges in front of them.

Wyshbox life insurance is there to help make sure that life post-you is everything you want it to be. Wyshbox provides term life insurance tailored to everyone’s specific needs with policies that can help take care of your family, kids, pets, friends, funeral arrangements, and so much more. It takes less than 10 minutes, is 100% online, and plans start at just $9 per month.

Copyright © 2022 Wysh Life and Health Insurance Company

*Disclosures at: www.wyshbox.com/ad-disclosures

1 Wyshbox Life Insurance. Quantitative Survey “Women during COVID and Recession”. 400 participants. August 8, 2022

2 Wyshbox Life Insurance. Quantitative Survey “Thematic Survey”. 1200 participants. November 2021